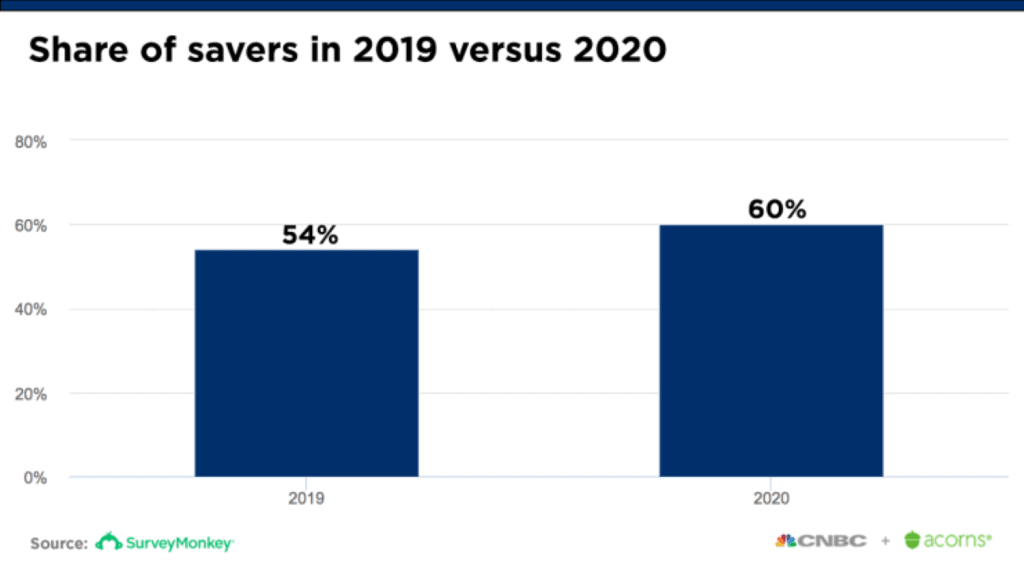

As the coronavirus sweeps the world and people take a step back to look at their financial picture, they are realizing that they do not have a company 401(K).

Even though some of these people work at a company where they offer a 401(k), they may not be eligible due to not meeting criteria, such as length of employment, or they are not a full-time employee.

So, as people are stressing more about the importance of having a hefty savings account, it’s a great time to discuss options for individuals who are not eligible for their company 401(k) or do not have one through their workplace. Below we will share several options for people in this situation according to an article by MorningStar.

1) Invest in an IRA.

A good first step for someone without a 401(k) is setting up an IRA. An IRA is a great other step to save for retirement and seek tax benefits. You are eligible to contribute $6,000 a year to your IRA.

2) Look Into Self-employment accounts are an option.

For self-employed individuals, there are several options to consider. Some of them are similar to 401(k)s but are just set up a bit differently. Speak with a financial professional to see what options you can set up for yourself.

3) Consider an HSA

If you have a high-deductible health care plan you can consider setting up an HSA in order to save some of those dollars and grow your money tax deferred.

4) Open a Taxable brokerage account.

While its always nice to grow your money tax deferred, investing in a regular taxable account is always a great option. You can speak with a tax professional to see how to do so in a tax efficient manner.

5) Be part of the solution.

Lastly, if you work for a small employer without a 401(k), maybe ask them to see if it’s something they are interested in starting. Never hurts to ask!

As always, if you have any questions about your current 401(k) or need help investing money in order to supplement a lack of one, please reach out to us and we would be happy to discuss your future financial goals.