10 Things to Discuss Before the Big Day

You are excited, in love, and planning the wedding of your dreams. Probably the only money questions on your mind are the down payments for the caterers and the florists!

Yet – whether your wedding reflects a minimalist sensibility or is a no-holds-barred extravaganza – it’s better to have a good understanding of each other’s finances before the “I Do’s”. This is a time when procrastination could cost you a bundle, even if neither one of you currently have a lot of assets.

Getting married is more than just substituting the word “ours” for “yours” and “mine”. It’s combining your finances, histories, dreams, aspirations, possessions – even your music – and making all of that “ours” too. Since a significant part of those dreams and aspirations involve money, having multiple financial conversations before marriage (or right after, if you’re newlyweds!) can help you start married life on a firmer footing, with regard to financial goals.

Here are a few conversations that will get your marriage off to a smoother financial start:

1) Views on money. How we feel about money is often very emotional and very personal. Our family’s views on money can have a big impact on the way we see finances. In some families money may not be talked about. In others, one partner may hide money or spending from the other. While we might not consciously have these same behaviors, our upbringing will have an impact on how we feel about money and how we save, spend, and budget.

The best way to address unconscious – and sometimes conflicting – money behaviors is to start by recognizing how you each feel about money. Then you can take a practical approach and implement the best strategies from the past and incorporate them into your new relationship. This will also give you a chance to address any not-so-beneficial attitudes and behaviors and work to consciously change them.

2) Spending/Saving Habits. Chances are the two of you don’t spend and save money the same way. The interesting thing about spending and saving habits is that they give insight into priorities, both financial and otherwise because we tend to spend money on things we feel are most important and scoff at spending on things we see as unimportant. Some people value saving more than anything and could be considered “tightwads”. Other people have a “live for today” attitude and spend whatever they have available, saving nothing or little for later. Most of us find ourselves somewhere in the middle.

Not agreeing on spending priorities can lead to serious conflicts down the line. While there is no right and wrong answer regarding priorities and habits, it’s valuable to know and understand each other’s habits earlier rather than later.

3) Divvying Up the Bills. This is an important conversation about how you will manage your money together. Will you have separate or joint accounts? Who will be responsible for paying the bills and investing for long term goals? A realistic understanding both of your current incomes and current debts is important so you can create a realistic budget based on your combined income and expenses.

4) Credit History. No one likes to talk about credit ratings because they highlight past mistakes and spending habits. Yet it’s essential to know and discuss your credit histories. This can help you talk about past money mistakes, current debt loads, and how to address any issues that are lurking. Having this conversation now will also help if you’re planning to borrow money for a large purchase, such as a home or car; credit history will effect how much you’ll pay in interest for loans, as well as how much it will cost for things like insurance. Many companies even pull credit for potential job applicants. When it comes to credit, it’s best not to have surprises down the road, so have the conversation now.

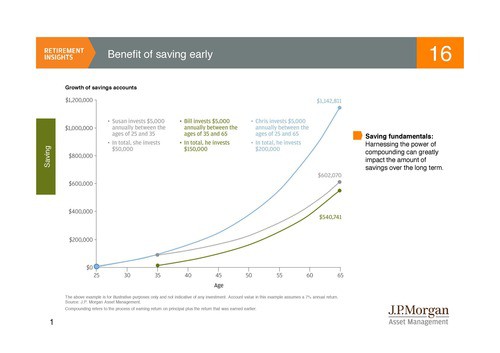

5) Risk Tolerance and Financial Goals. Couples often have very strong – and differing – feelings about risk and money that are deeply rooted in past experiences. Your family may have gone through periods of unemployment, for instance, or you may have grown up taking financial security for granted. One of your parents may have owned a business and you saw it go bankrupt, so you might be very conservative with your money and not want to take unnecessary chances. Or perhaps they invested in a business that was a huge success.

Everyone brings a different level of comfort when it comes to risk tolerance and it’s important to understand your partner’s because it has an impact on spending and savings habits – everything from where you invest to how much money you want to set aside. Money provides a level of security that can be very powerful and risk tolerance is directly linked to that feeling of security.

6) Ongoing Financial Obligations. If this is a second marriage, are there child support or alimony payments that need to be considered in the budget process? If so, how much and how long will the obligations need to be fulfilled. Caring for elderly parents might also be a long term expense you will be facing as a couple.

7) Net Worth. When it’s a first marriage, often neither partner has much in the way of assets, but if one partner has more than the other, are you going to want a pre-nuptial agreement? When discussing net worth it is valuable to discuss not only current net worth, but also aspiring net worth. What household income level are you both hoping to achieve. Will reaching those aspirations include additional education? Will it mean switching jobs several times early in your career? Will it mean working 80 hours a week for decades? As a couple, understanding financial expectations and future net worth aspirations will help you plan a life together that will meet both of your needs, financially and emotionally.

8) Family Plans. The family size you hope to have will also have a big impact on your financial needs. Children, as wonderful as they are, are very expensive to raise. Do you both want to have children and, if so, one child or several children? Discussions about how the children will be raised and educated are also valuable from a financial perspective. Will one of you stay home to raise the children? Will you pay for day care? How far apart should the children be? Each of these answers will have a significant financial impact to the family budget.

9) Combining Physical and Financial Assets. Particularly with couples getting married later, both partners will have accumulated possessions that now need to be combined. This can be as simple as which sofa and bedroom set to keep, or more complicated when multiple homes, retirement accounts, and other investments are brought into the mix. Discussing whether property, accounts, and debt should be left in individual names or held jointly is also an important conversation to have.

10) Wills, Trusts, and Life Insurance. When you’re getting married, you don’t really want to think about death. Yet wills, trusts, and life insurance need to be updated soon after you say, “I Do.” This is true especially if you have assets or children. The process of obtaining a will or trust is fairly straightforward; it’s the discussions that lead up to it that provide the most value. Both of you should have a good understanding of what you have and what you want to happen, should the unthinkable occur.

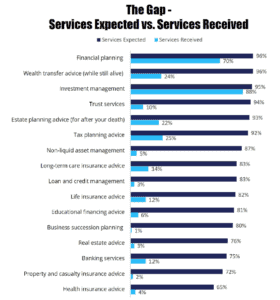

Financial advisors can be a real asset, when it comes to pre-marital financial discussions. They can help you determine when it is best to hold assets jointly or separately. Assistance with budgeting and planning for long term goals will help you create a strong financial plan. Advisors can also guide you in building a strategy for reaching financial milestones.

So, if you’re getting married (or just got married), congratulations! And while these discussions may not be the most romantic ones you’re having, they do have the ability to bring you closer together. Planning together and sharing your dreams will give you better insight into the mind and heart of the person you’ve fallen in love with and allow you to become stronger partners when it comes to reaching your goals as a couple, emotional as well as financial.

***

The views expressed in this blog post are as of the date of the posting, and are subject to change based on market and other conditions. This blog contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Please note that nothing in this blog post should be construed as an offer to sell or the solicitation of an offer to purchase an interest in any security or separate account. Nothing is intended to be, and you should not consider anything to be, investment, accounting, tax or legal advice. If you would like investment, accounting, tax or legal advice, you should consult with your own financial advisors, accountants, or attorneys regarding your individual circumstances and needs. No advice may be rendered by Sherman Wealth unless a client service agreement is in place.

If you have any questions regarding this Blog Post, please Contact Us.