This article was originally published on investopedia.com

One of the biggest challenges to our own success can be our own instinctive behavioral biases. In previously discussing behavioral finance, we focused on four common personality types of investors.

Now let’s focus on the common behavioral biases that affect our investment decisions.

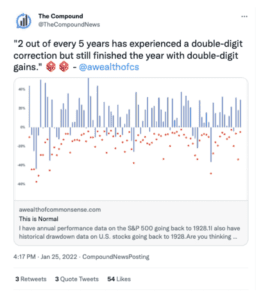

The concept of behavioral finance helps us recognize our natural biases that lead us to making illogical and often irrational decisions when it comes to investments and finances. A prime example of this is the concept of prospect theory, which is the idea that as humans, our emotional response to perceived losses is different than to that of perceived gains. According to prospect theory, losses for an investor feel twice as painful as gains feel good. Some investors worry more about the marginal percentage change in their wealth than they do about the amount of their wealth. This thought process is backwards and can cause investors to fixate on the wrong issues.

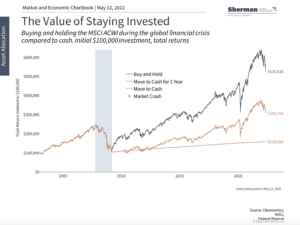

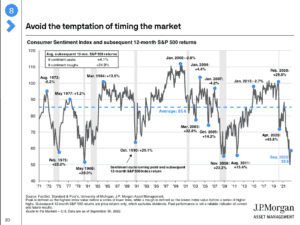

The chart below is a great example of this emotional rollercoaster and how it impacts our investment decisions.

The Psychology of Investing Biases

Behavioral biases hit us all as investors and can vary depending upon our investor personality type. These biases can be cognitive, illustrated by a tendency to think and act in a certain way or follow a rule of thumb. Biases can also be emotional: a tendency to take action based on feeling rather than fact.

Pulled from a study by H. Kent Baker and Victor Ricciardi that looks at how biases impact investor behavior, here are eight biases that can affect investment decisions:

- Anchoring or Confirmation Bias: First impressions can be hard to shake because we tend to selectively filter, paying more attention to information that supports our opinions while ignoring the rest. Likewise, we often resort to preconceived opinions when encountering something — or someone — new. An investor whose thinking is subject to confirmation bias would be more likely to look for information that supports his or her original idea about an investment rather than seek out information that contradicts it.

- Regret Aversion Bias: Also known as loss aversion, regret aversion describes wanting to avoid the feeling of regret experienced after making a choice with a negative outcome. Investors who are influenced by anticipated regret take less risk because it lessens the potential for poor outcomes. Regret aversion can explain an investor’s reluctance to sell losing investments to avoid confronting the fact that they have made poor decisions.

- Disposition Effect Bias: This refers to a tendency to label investments as winners or losers. Disposition effect bias can lead an investor to hang onto an investment that no longer has any upside or sell a winning investment too early to make up for previous losses. This is harmful because it can increase capital gains taxes and can reduce returns even before taxes.

- Hindsight Bias: Another common perception bias is hindsight bias, which leads an investor to believe after the fact that the onset of a past event was predictable and completely obvious whereas, in fact, the event could not have been reasonably predicted.

- Familiarity Bias: This occurs when investors have a preference for familiar or well-known investments despite the seemingly obvious gains from diversification. The investor may feel anxiety when diversifying investments between well known domestic securities and lesser known international securities, as well as between both familiar and unfamiliar stocks and bonds that are outside of his or her comfort zone. This can lead to suboptimal portfolios with a greater a risk of losses.

- Self-attribution Bias: Investors who suffer from self-attribution bias tend to attribute successful outcomes to their own actions and bad outcomes to external factors. They often exhibit this bias as a means of self-protection or self-enhancement. Investors affected by self-attribution bias may become overconfident.

- Trend-chasing Bias: Investors often chase past performance in the mistaken belief that historical returns predict future investment performance. This tendency is complicated by the fact that some product issuers may increase advertising when past performance is high to attract new investors. Research demonstrates, however, that investors do not benefit because performance usually fails to persist in the future.

- Worry: The act of worrying is a natural — and common — human emotion. Worry evokes memories and creates visions of possible future scenarios that alter an investor’s judgment about personal finances. Anxiety about an investment increases its perceived risk and lowers the level of risk tolerance. To avoid this bias, investors should match their level of risk tolerance with an appropriate asset allocation strategy.

Avoiding Behavioral Mistakes

By understanding the common behavioral mistakes investors make, a quality financial planner will aim to help clients take the emotion out of investing by creating a tactical, strategic investment plan customized to the individual. Some examples of strategies that help with this include:

- Systematic Asset Allocation: We utilize investment strategies such as dollar cost averaging to create a systematic plan of attack that takes advantage of market fluctuations, even in a down market period.

- Risk Mitigation: The starting point of any investment plan starts with understanding an individual’s risk tolerance.

The most important aspect of behavioral finance is peace of mind. By having a thorough understanding of your risk appetite, the purpose of each investment in your portfolio and the implementation plan of your strategy, it allows you to feel much more confident about your investment plan and be less likely to make common behavioral mistakes.

Working with a financial planner can help investors recognize and understand their own individual behavioral biases and predispositions, and thus be able to avoid making investment decisions based entirely on those biases.

***