In today’s ever-evolving economic environment, mastering the art of saving is essential for achieving financial stability and building your wealth. Whether you’re saving for a rainy day, a dream vacation, or retirement, implementing an effective savings strategy can make all the difference. As financial advisors, we work with clients on automating their savings to seamlessly grow their wealth and get one step closer towards their goals. In this blog post, we’ll share some valuable tips for savers on savings strategies and the prudence of creating an automated savings plan.

Before diving into savings strategies, let’s emphasize why automating savings is crucial. Automating the process of saving money towards your various goals each month or pay period makes the process more seamless and essentially “out of sight, out of mind”.

One of the most effective ways to save consistently is by automating your savings. Setting up automatic transfers from your checking account to your savings account each pay period or month ensures that you prioritize savings without the need for constant manual intervention. This “out of sight, out of mind” approach eliminates the temptation to spend money earmarked for savings, making it easier to stick to your financial goals.

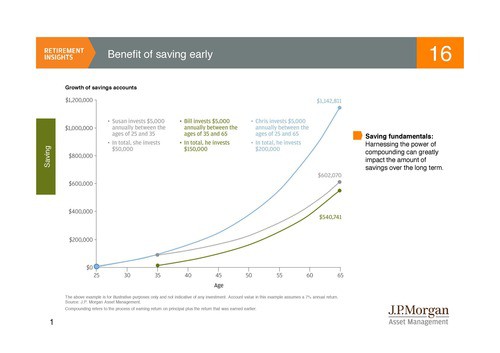

Consistency is also the cornerstone of successful saving. By automating your savings, you establish a routine that becomes “automatic” in your financial habits. Whether you’re saving a fixed amount or a percentage of your income, committing to regular contributions reinforces responsible financial behavior and accelerates wealth accumulation over time.

In addition to automated savings, consider implementing dollar-cost averaging (DCA) as a strategy for investing in your taxable brokerage account. DCA involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This approach mitigates the risk of timing the market and allows you to benefit from market volatility by purchasing more shares when prices are low and fewer shares when prices are high.

So, given the savings strategies we just mentioned above, here are some practical tips to optimize your savings strategy:

Set Clear Goals: Define your short-term and long-term financial goals to guide your saving efforts. Whether it’s building an emergency fund, saving for a down payment on a house, or funding your retirement, having specific goals keeps you motivated and focused.

Track Your Expenses: Monitor your spending habits to identify areas where you can cut back and allocate more funds towards savings. Budgeting apps and expense tracking tools can help you gain insight into your financial behavior and make informed decisions.

Establish Emergency Fund: Prioritize building an emergency fund to cover unforeseen expenses that may arise in an emergency. Aim to save enough to cover a comfortable amount of months worth of living expenses to provide a financial cushion during challenging times.

Maximize Retirement and Tax Advantageous Accounts: Take advantage of retirement accounts such as 401(k)s, IRAs, and Health Savings Accounts (HSAs) as a way to complement cash savings and build your wealth.

Review and Adjust Regularly: Periodically review your savings goals, investment performance, and overall financial situation. Adjust your savings strategy as needed to stay on track and adapt to changes in your life circumstances or financial markets.

In all, your savings strategy will probably require discipline, consistency, and strategic planning. By automating your savings and following these tips, you can set yourself accountable in reaching your financial goals. If you have any questions on how to increase or enhance your savings strategy, email info@shermanwealth.com or schedule a complimentary meeting here.