GOP presidential nominee Donald Trump has had one of the most hectic campaigns in recent memory. He has made so many newsworthy remarks that it is hard to keep up. One day last week was particularly impressive as he made over 10 news-making assertions in under 24 hours. These included initially refusing to endorse House Speaker Paul Ryan, doubling down on his feud with Gold Star parents Khizr and Ghazala Khan and predicting that the election will be rigged. (For more, see: The Conflicts of Interest Around 401(k)s.)

Whether you support him or not, simply finding the time in the day to make all those remarks (and more) is impressive. But there was one opinion in particular that caught our eye, via CBS’s Sopan Deb. Trump made the below statements during an interview with FOX Business Network’s Stuart Varney:

Varney: For the the small investor, the average guy, right now, would you say, yes, put your 401(k) money into stocks?

Trump: No, I don’t like a lot of things that I see. I don’t like a lot of the signs that I’m seeing. I don’t like what’s happening with immigration policies. I don’t like the fact that we’re moving tremendous numbers of people from Syria are coming into this country and we don’t even know it. Thousands of people, thousands and thousands of people. There’s so many things that I just don’t like what I’m seeing. I don’t like what I’m seeing at all. Look, interest rates are artificially low. If interest rates ever seek a natural level, which obviously would be much higher than they are right now, you have some very scary scenarios out there. The only reason the stock market is where it is—is because you get free money.

Trump’s Approach

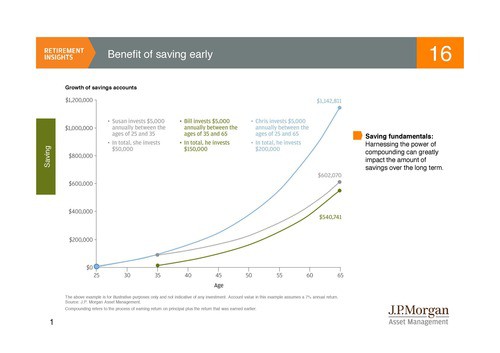

Even if you are his number one fan, please don’t hire Donald Trump to manage your 401(k). First of all, setting aside the economic truth of what Trump is saying and whether his fears will ultimately influence the market as much as he thinks, every factor that he mentions in his response is short-term. As Trump is 70 years old, focusing on what’s coming immediately down the line is understandable. But most investors have longer to go until retirement and therefore need to be invested in the stock market’s long-term gains, particularly those investors without Trump’s level of wealth. (For more, see: Why Playing It Safe Could Hurt Your Retirement.)

As Bloomberg points out, Trump’s strategy basically amounts to timing the market. We believe that in the long run, due to the efficient market hypothesis, you can’t beat the returns of the market through individual stock selection and market timing. Therefore, the safest thing to do is to stick with the market, while of course monitoring constantly and rebalancing.

Trump’s approach could be a recipe for long-term disaster. Fidelity Investments has compared how investors who pulled out of the market near its bottom in 2008-09 fared versus those who stayed. Those investors who stuck with the market ended 2015 $82,000 richer than those who withdrew, on average. (For related reading, see: Why Investors Can Be Their Own Worst Enemy.)

So even if Trump is completely correct, it is not a good strategy for a long-term retirement saver, which is the demographic he was asked about. If Donald Trump applied his advice to your 401(k), you’d probably do worse than if you ignored him, even in the case of a market correction.

Asked about alternatives to the stock market, Trump would likely point to real estate (we wrote about that here), which is where most of his dealings have been. The answer is somewhere in between a diversified portfolio with investments in real estate (if you can afford it), but also stocks, bonds, the money market, etc. If a market correction really is coming as Trump predicts, then the best hedge against it isn’t to pull all your money out of equities. Rather, for most savers, we think the best protections are a long-term financial plan and a diversified portfolio, both of which account for short-term market volatility.

This article was originally published on Investopedia.com

***

The views expressed in this blog post are as of the date of the posting, and are subject to change based on market and other conditions. This blog contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Please note that nothing in this blog post should be construed as an offer to sell or the solicitation of an offer to purchase an interest in any security or separate account. Nothing is intended to be, and you should not consider anything to be, investment, accounting, tax or legal advice. If you would like investment, accounting, tax or legal advice, you should consult with your own financial advisors, accountants, or attorneys regarding your individual circumstances and needs. No advice may be rendered by Sherman Wealth unless a client service agreement is in place.

If you have any questions regarding this Blog Post, please Contact Us.