Whether you realize it or not, chances are good that you are prone to something called Recency Bias, which is the common tendency to think that what has been happening recently will continue to happen in the near future.

If you, like many investors, are shocked and concerned about February’s sudden market volatility, it’s probably a result of Recency Bias. The last 18 months of smooth sailing without market volatility got many investors lulled into thinking that that trend would continue indefinitely.

We all know that markets experience volatility and, until 18 months ago, it was considered reasonably normal, but no one likes the thought of taking a loss. It’s hard not to panic if your oldest child is in college and her 529 just took a hit or if you’re a year away from retirement and your IRA just lost 15% of it’s paper value.

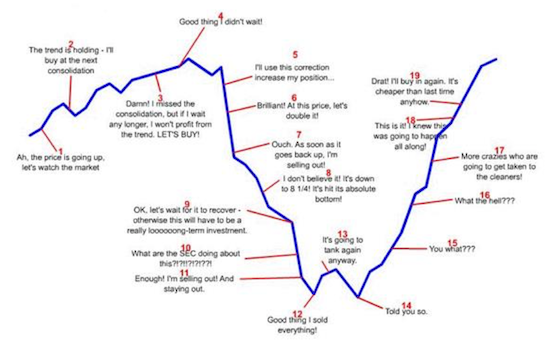

Although you no doubt know that impulsive trading is one of the least efficient ways to reach your true long-term investment potential, emotions are powerful drivers. In fact, in Robert Shiller’s book “Irrational Exuberance,” he states that the emotional state of investors “is no doubt one of the most important factors causing the bull market” we just recently experienced.

The chart below shows that investor sentiment dropped 30% in the beginning of the year, suggesting that investors’ overall attitude may have been veering from bullish to bearish, although it did bounce back this week. What it also suggests is that Recency Bias caused investors’ to react more strongly to typical market volatility because it was a-typical during the long period of calm we just experienced.

The key in times of volatility is to keep your eye on your long-term goals rather than reacting impulsively to temporary trends. In Taking The Sting Out Of Investment Loss, Brian Boch advises: “The golden rule is to differentiate between [decisions] based on rational and prudent trading strategies on the one hand and emotionally-based, panicky decisions on the other. The former generally leads to success over time, while the latter tends to lead to failure.”

Here at Sherman Wealth Management we believe there is productivity and security in planning for the unknown by defining what it is you already do know. Knowing yourself, your emotions, and the risk you are willing to take is the first step. The second is creating a long-term financial plan with a conflict-free, Fiduciary advisor.

In a recent post, Ben Carlson wrote:

“The prep time for a market correction or crash comes well before it actually happens by:

- Setting realistic expectations.

- Mapping out a course of attack for when losses occur.

- Making decisions ahead of time about what moves (if any) to make and when depending on what happens.

- Deciding on the correct level of risk to be taken.

- Building behaviorally-aware portfolios.”

The best solution to financial and emotional volatility is to work with a financial planner on a plan that will make you feel comfortable through the market’s natural ups and downs. You may not be able to control outside factors but you can control your reactions by recognizing how bias works and by preparing both emotionally and financially to reach the long-term goals that matter to you.

And, as always, if you’d like to review your plan and how your allocations conform to your own risk tolerance and response to volatility, please let me know and we’ll schedule a call.